The cost of dealing with a data breach can be disastrous. It goes beyond simply repairing databases, strengthening security protocols, paying possible ransoms, or replacing lost laptops. Compliance regulations require affected clients and/or patients to be notified when their data is compromised, This can affect the reputation of an organization as well. We’ve reached a point where we all work with data so much that we need protection from the financial devastation caused by data loss or breach. Traditional business insurance may not be enough to cover all the costs of a cyber crime nor be enough to help maintain vital business continuity.

This is where cyber insurance steps in.

What is Cyber Insurance?

Cyber liability insurance is an insurance policy that provides businesses with a combination of coverage options to help protect the organization from data breaches involving customer information and other cyber security issues. If your organization falls victim to a cyber-attack, cyber insurance will cover you in the way car insurance covers you when your vehicle is in an accident.

Cyber insurance comes in many different forms of coverage, and to understand what’s best for you and your organization, you’ll need to work with an insurance agent.

Why Cyber Insurance?

Organizations have a legal obligation to keep their clients’ and/or patients’ protected health information (PHI) and personally identifiable information (PII) confidential and secure. They face potential liability if the information is exposed in a data breach. Cyber insurance coverage protects organizations for liability to others and reimburses them for expenses related to a data breach, which could include legal fees, a digital forensics team, notification costs, and crisis communications.

Cyber insurance can also help cover costs related to business continuity which can help your business avoid costly downtime.

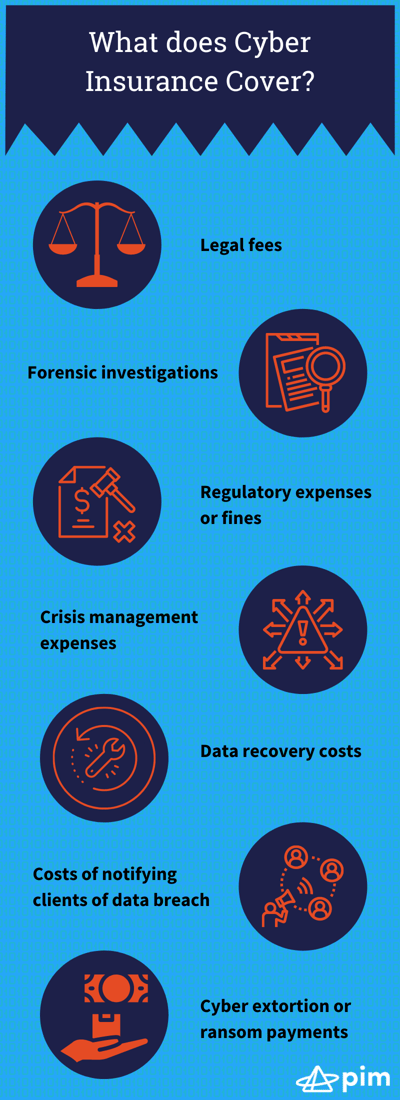

What does Cyber Insurance typically cover?

Cyber liability insurance can cover costs associated with data breaches and cyber-attacks upon your business. These costs can include such things as lost income due to hacking and business downtime, costs associated with notifying customers or clients affected by the breach, costs for recovering compromised data, and costs for repairing damaged computer systems and more.

Cyber insurance can be a safeguard against the devastating financial consequences of a data breach. When choosing a cyber liability insurance policy, you should look for ones that address/cover:

- Legal fees

- Forensic investigations

- Regulatory expenses or fines

- Crisis management expenses

- Costs of recovering data

- Costs of notifying clients, patients, or customers of the data breach/loss

- Costs of restoring the identities of affected clients, patients, or customers

- Business interruption

- Cyber extortion/ransom

Who needs Cyber Liability Insurance?

Every company and organization that houses digital information and uses technology to conduct business faces IT security risks. As technology advances, so do the strategies deployed by hackers and bad actors. Every business needs a plan to outwit these bad actors in the form of a cyber security strategy to prevent data breaches from occurring, but also cyber liability insurance to help mitigate to associated costs of the inevitable. Cyber liability insurance is part of a comprehensive IT security strategy that can help your organization when data breaches occur.